Tax Implication Of Section 9B And 45(4) On Admission Of New Partner In Partnership Firm

1. Introduction

1.1. Finance Act 2021 has brought in

new income-tax provisions related to reconstitution and dissolution of

Partnership firms, Association of persons and Body of Individuals (not being a

company or a co-operative society). For which a new section 9B is inserted

under the Chapter II (Basis of Charge) and old section 45(4) is being

substituted with the new one.

1.2. Owing to these new provisions,

there has been paradigm shift in the manner of taxation on account of

reconstitution or dissolution of the firms. Amended provisions of section 45(4)

tax the Profit or Gain arising to partners, who are taking with them any asset or

money or both from the firm at the time of reconstitution of the firm (erstwhile

section 45(4) was covering the case of dissolution). Provisions of section 9B charge

to tax the gain arising to the partner in the hands of the firm whenever

partner/s take away Capital asset or Stock in trade or both as a result of

reconstitution or dissolution of the firm.

1.3. Apparently, section 9B is not

covering the cases where Money is being received by the partners at the time of

dissolution (Could be because, money is generated out of transactions which are

already taxed like sales, realization from debtors, sale of assets etc.).

1.4. It is imperative to understand

that these provisions get triggered only when any asset, money or stock in

trade is received by the partner at the time of reconstitution or dissolution

of the firm. Otherwise, these provisions do not get triggered.

1.5. Further, section 48 is also

amended by inserting clause (iii). As per memorandum to the Finance bill 2021

the intention behind inserting this clause is to mitigate the double taxation

which might have happened in a situation where an asset which was revalued and

for which income under the proposed sub-section (4A) of section 45 of the Act

was brought to tax is transferred subsequently by the specified entity.

(however, instead of proposed new sub-section 4A, existing sub-section (4) was

substituted)

1.6. These amendments touch upon many

nuances of reconstitution and dissolution of firm but the topic to be discussed

here is particularly of reconstitution wherein one or more new partners are

admitted in the firm.

2. Relevant Provisions

2.1. Before moving on to the detailed discussion

on various taxation aspects, it is imperative to refer exact provisions of

section 9B and 45(4), same are reproduced as under,

2.2. Provisions of section 9B are

reproduced herein under,

‘9B. [Income on receipt of

capital asset or stock in trade by specified person from specified entity.

(1) Where a specified person receives during

the previous year any capital asset or stock in trade or both from a specified

entity in connection with the dissolution or reconstitution of such specified

entity, then the specified entity shall be deemed to have transferred such

capital asset or stock in trade or both, as the case may be, to the specified

person in the year in which such capital asset or stock in trade or both are received

by the specified person.

(2) Any profits and gains arising

from such deemed transfer of capital asset or stock in trade or both, as the

case may be, by the specified entity shall be—

(i) deemed to be the income of

such specified entity of the previous year in which such capital asset or stock

in trade or both were received by the specified person; and

(ii) chargeable to income-tax as

income of such specified entity under the head "Profits and gains of

business or profession" or under the head "Capital gains", in

accordance with the provisions of this Act.

(3) For the purposes of this

section, fair market value of the capital asset or stock in trade or both on

the date of its receipt by the specified person shall be deemed to be the full

value of the consideration received or accruing as a result of such deemed

transfer of the capital asset or stock in trade or both by the specified

entity.

(4) If any difficulty arises in

giving effect to the provisions of this section and sub-section (4) of section 45, the Board may, with the approval of the Central

Government, issue guidelines for the purposes of removing the difficulty.

(5) Every guideline issued by the

Board under sub-section (4) shall, as soon as may be after it is issued, be

laid before each House of Parliament, and shall be binding on the income-tax

authorities and on the assessee.

Explanation.—For the purposes of

this section,—

(i) "reconstitution of the

specified entity" means, where—

(a) one or more of its partners

or members, as the case may be, of such specified entity ceases to be partners

or members; or

(b) one or more new partners or

members, as the case may be, are admitted in such specified entity in such

circumstances that one or more of the persons who were partners or members, as

the case may be, of the specified entity, before the change, continue as

partner or partners or member or members after the change; or

(c) all the partners or members,

as the case may be, of such specified entity continue with a change in their

respective share or in the shares of some of them;

(ii) "specified entity"

means a firm or other association of persons or body of individuals (not being

a company or a co-operative society);

(iii) "specified

person" means a person, who is a partner of a firm or member of other

association of persons or body of individuals (not being a company or a

co-operative society) in any previous year.’

2.3. Provisions of section 45(4) are

reproduced herein under,

[(4) Notwithstanding anything

contained in sub-section (1), where a specified person receives during the

previous year any money or capital asset or both from a specified entity in

connection with the reconstitution of such specified entity, then any profits

or gains arising from such receipt by the specified person shall be chargeable

to income-tax as income of such specified entity under the head "Capital

gains" and shall be deemed to be the income of such specified entity of the

previous year in which such money or capital asset or both were received by the

specified person, and notwithstanding anything to the contrary contained in

this Act, such profits or gains shall be determined in accordance with the

following formula, namely:—

A = B + C - D

Where,

A = income chargeable to

income-tax under this subsection as income of the specified entity under the

head "Capital gains";

B = value of any money received

by the specified person from the specified entity on the date of such receipt;

C = the amount of fair market

value of the capital asset received by the specified person from the specified

entity on the date of such receipt; and

D = the amount of balance in the

capital account (represented in any manner) of the specified person in the

books of account of the specified entity at the time of its reconstitution:

Provided that if the value

of "A" in the above formula is negative, its value shall be deemed to

be zero :

Provided further that the

balance in the capital account of the specified person in the books of account

of the specified entity is to be calculated without taking into account the

increase in the capital account of the specified person due to revaluation of

any asset or due to self-generated goodwill or any other self-generated asset.

Explanation 1.—For the purposes

of this sub-section,—

(i) the expressions

"reconstitution of the specified entity", "specified

entity" and "specified person" shall have the meanings

respectively assigned to them in section 9B;

(ii) "self-generated

goodwill" and "self-generated asset" mean goodwill or asset, as

the case may be, which has been acquired without incurring any cost for

purchase or which has been generated during the course of the business or

profession.

Explanation 2.—For the removal of

doubts, it is clarified that when a capital asset is received by a specified

person from a specified entity in connection with the reconstitution of such

specified entity, the provisions of this sub-section shall operate in addition

to the provisions of section 9B and the taxation under the said provisions

thereof shall be worked out independently.]

2.4. While, as per clause 23 of

section 2, Firm includes Limited Liability Partnership Firm.

3. Discussion

3.1. The meaning of reconstitution, as explained in section 9B, provides for three different scenarios which will be considered as ‘reconstitution’. Amongst which clause (b) provides for the situation where one or more new partners are admitted to the firm.

Clause

‘b’ is, as under,

(b) one or more new partners or

members, as the case may be, are admitted in such specified entity in such

circumstances that one or more of the persons who were partners or members, as

the case may be, of the specified entity, before the change, continue as

partner or partners or member or members after the change; or

3.2. Above clause can be dissected as

under,

- One or more new partners are

admitted

- In Specified Entity (i.e. Firm)

and

- Old Partners continues to be

partner after such change (i.e. admission)

3.3. The moot question is, whether

mere admission of new partner leads to taxation u/s 9B or section 45(4) ?

Generally,

when a new partner is added, old partner may withdraw part of their share.

For

example, A

and B are partner with equal PSR in firm M/s PQR having capital balance of

Rs.100 each and having 4 capital assets (E, F, G and H) of book value Rs.50

each (assume Long term). A new partner Mr. C would be joining the firm PQR for

1/3rd share, so revaluation of assets is done at Rs.200/- each and

Mr. A and Mr. B wishes to take away one capital asset each namely E and F.

3.4. Thus, in such situation where the

continuing partners take away the assets (or money or stock in trade) provisions

of section 9B and 45(4) will get triggered at the time of admission of partners.

Basically, capital asset/money/Stock in trade should be received by partner IN

CONNECTION with reconstitution/dissolution i.e. in cases where the capital

accounts are credited at the time of admission of new partner and capital

asset/money/stock in trade is withdrawn at a later date/ year then also Sec.9B r.w.s. 45(4) will be applicable application.

3.5. Further, it be noted that,

provisions of section 45(4) are triggered when Capital asset or money or both are

taken away by partners (i.e. received by the partners). While provisions of

section 9B gets triggered when partner(s) receives Capital Asset or Stock in

trade or both. Thus, in case of transfer of Capital Asset to specified person provisions

of section 9B as well as 45(4) both gets attracted in the hands of specified

entity.

3.6. Besides, if among the partners there

is an understanding where consideration is paid without involving the Firm

(i.e. out of books) and there is reconstitution where the Profit/ Loss/ Capital

Ratio is changed then, though such situation is reconstitution it appears

Sec.9B/ 45(4) gets no force of law.

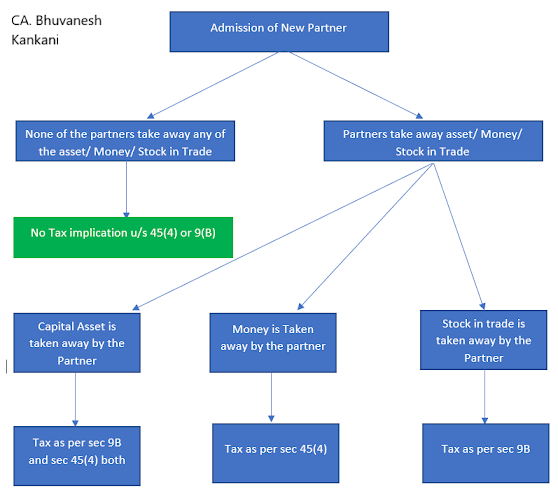

3.7. Proposition explained in Para 3.5

above is explained in the following chart dealing with different scenarios:

4. Determination of amount of income

4.1. As discussed above, whenever

partner receives any capital asset/stock in trade/money and it leads to gains

in the hands of receiving partner then such gains are deemed to be the income

of the firm of the year in which such asset/Stock in trade/money is received by

the partner in connection of reconstitution.

4.2. As per section 9B and 45(4), in

case of Capital asset and stock in trade, the fair market value as on date of

reconstitution will be the full value of consideration received or accruing to

the firm as a result of such deemed transfer.

4.3. Section 9B creates the charge of

tax but routes the taxability into respective heads of income. i.e. in case

capital asset is transferred then taxability is to be determined under the head

‘Capital Gains’ whereas if stock in trade is transferred taxability is to be

determined under the head ‘Profit and Gains from business or profession’.

Though, section 9B is routing the taxability to respective heads, it fixes the

full value of consideration to be the FMV.

4.4. Since, section 9B routes the

transaction to respective head of income, the computation would also be done as

per relevant provisions therein. That is, in case of Capital asset, Full Value

of consideration will be FMV (as per section 9B), while cost of acquisition

(including indexed cost of acquisition) and period of holding will be

determined as it is done regularly.

4.5. While section 45(4) provides the

mechanism of computing the gains arising in the hands of partner which is to be

deemed as income of firm. A formula is provided in Section 45(4) to determine

the gain. The formula, as provided under section 45(4), is ‘A= B + C – D’ ,

wherein B and C is the value of money and Fair market value of asset received

by the partner while D refers to the capital balance of respective partner at the

time of reconstitution.

4.6. Thus, taxable income u/s 45(4)

would arise only in those cases where the aggregate of Value of Money and FMV

of capital asset received by the partner exceeds the capital balance of the

respective partner at the time of reconstitution.

4.7. Thus, in case capital asset is

transferred, provisions of section 9B and section 45(4) both will get attracted

(in case of reconstitution) and tax under both the sections would be computed

and required to pay, if any.

4.8. For example,

In firm M/s PQR there are two

partners namely Mr. A and Mr. B with equal PSR having capital balance of Rs.100

each and there are 4 capital assets being land (E, F, G and H) of book value

Rs.50 each (assume Long term). A new partner Mr. C would be joining the firm

PQR for 1/3rd share, so revaluation of assets is done at Rs.200/-

each, considering the report of registered valuer as mentioned in rule 11U(g).

Further, Mr. A and Mr. B wishes to take away one capital asset each namely E

and F respectively.

Above facts can be demonstrated

as under,

|

Assets |

Existing values |

Revalued Values |

Assets (land) |

Existing values |

Revalued Values |

|

Mr. A |

100 |

400 |

E (to be received by Mr. A) |

50 |

200 |

|

Mr. B |

100 |

400 |

F (to be received by Mr. B) |

50 |

200 |

|

|

|

|

G |

50 |

200 |

|

|

|

|

H |

50 |

200 |

|

Total |

200 |

800 |

Total |

200 |

800 |

The taxation u/s 9B will be as

under (similar for Mr. A and Mr. B),

|

Particulars |

Amount in INR |

Remarks, if any |

|

Full Value of

consideration |

200 |

FMV of Capital Asset

|

|

Less: Indexed cost

of Acquisition |

75 |

Assumed |

|

Capital Gain |

125 |

Long Term Capital

Gain |

|

Thus, tax |

25 |

20%, (assume no

surcharge cess etc for ease of calculations) |

|

Net Book profit

after taxes |

100 |

(total Rs.200 for

both the Capital asset i.e. G and H) |

Whereas, the taxation u/s 45(4)

will be as under (for Mr. A and Mr. B individually),

A= B + C – D

Value of,

B= Zero (as no money is being

received by the partners)

C= FMV of capital asset received

by the partner = Rs.200 (as given in example)

D=Capital balance at the

time of reconstitution= Rs.100

Thus, A= 0 + 200 – 100*

=

Rs.100/-

(*as per second proviso to 45(4),

the balance in capital account of specified person is to be calculated without

taking into account the increase in capital account due to revaluation of

asset, thus Rs.100 is considered instead of Rs.200)

Tax calculation on this amount is

discussed ahead in para 4.10.

4.9. It be please noted that, as per

section 45(4) capital balance AT THE TIME OF RECONSTITUTION has

to be considered.

However, in the examples given in the guideline

issued by CBDT on 2nd July 2021 (14/2021), it has been demonstrated

that after determining gains u/s 9B the amount of net book profit after paying

taxes is to be transferred to the capital balances of the partners and such

increased capital balance is to be considered for determining gains u/s 45(4).

i.e., for the value of part ‘D’ of the formula.

In the instant example,

Gain as per section 9B is

Rs.125/- therefore tax on Long term capital asset is Rs.25 (cess, surcharges

etc. is not considered for sake of easy understanding). The net book profit

from transfer of capital asset is Rs.100/- (after taxes). And since, partner A

and B are taking away one asset each i.e. E and F, total net book profit for

both the assets is Rs.200 (after taxes). So, this gain of Rs.200/- is to be

transferred to the capital account of respective partners in their PSR. Thus,

the capital balance of partner A and B would become Rs.200 each (Rs. 100

existing + Rs.100/- amount of net book profit transferred to respective capital

account in PSR)

Accordingly, the calculation u/s

45(4) would now be as under (similar calculation for Mr. A and Mr. B both)

A =

0 + 200 – 200 [ value of money + FMV of capital asset- capital balance]

= Rs. 0 .

Since, Mr. A and Mr. B are

receiving asset E and F having same values, total taxable income u/s 45(4)

would be Rs.0 (Rs.0 each for in case of Mr. A and Mr. B both).

Considering such examples in

guideline, it would be interesting to imagine a case where reconstitution is

done in year 1 and capital asset is taken in subsequent year. Whether capital

balance AT THE TIME OF RECONSTITUON would be considered OR, as per the examples

given in the guideline, the increased value of capital balance after crediting,

to the respective capital account, the net book profit on transfer of capital asset,

as per 9B)

4.10. Type of Gain i.e. Long term or

short term

4.10.1. As per sub rule 5 of amended rule

8AA [as amended by the Income-tax Amendment(18th amendment), rule

2021], the amount or part of the amount chargeable u/s 45(4) shall be deemed to

be from

i. short term capital asset, if it

is attributed to

a. capital asset which is short term

capital asset at the time of taxation of amount under subsection (4) of section

45; or

b. capital asset forming part of

block of asset; or

c. capital asset being

self-generated asset and self-generated goodwill as defined in clause (ii) of

Explanation 1 to sub-section (4) of section 45; and

ii. long term capital asset or

assets, if it is attributed to capital asset which is not covered by clause (i)

and is long term capital asset at the time of taxation of amount under

sub-section (4) of section 45

In

above discussed example, the excess amount so determined (FMV of capital asset

minus capital balance at time of reconstitution) is attributable to remaining

capital assets i.e. Asset G and Asset H, which are also Long-term capital

asset. (please refer para no. 4.11 and 4.12)

4.10.2. Accordingly, the tax calculated

u/s 45(4) will also be a long-term capital gain @ 20% i.e. Rs.20 [considering gain of Rs.100 u/s 45(4) as mentioned at para 4.8 above]

4.10.3. Further, it may be noted that the

phrase ‘the amount or part of the amount’ used in sub rule (5) of rule 8AB, as

mentioned above in para 4.10.1. above, is an interesting aspect.

4.10.4. In above example, assume, Capital

Asset ‘H’ is a short-term capital asset then, in that case the attribution of

the excess amount (as determined through formula) would be added/ loaded on

remaining capital Assets of the firm i.e. Capital Asset ‘G and H’ which are

Long term capital asset and Short-Term Capital Asset respectively. Since, the

increase in valuation of both the asset is equal (i.e. from book value of Rs.50

to revalued amount of Rs.200) the attribution will be done equally between

Capital Asset G and H. Thus, the capital Gain tax in such case will be equal

i.e. half will be Long term and the other half will be Short term capital gain.

4.11. Attribution of tax paid u/s 45(4)

as per newly inserted clause (iii) u/s 48

Further, as per newly inserted

clause (iii) in section 48, the amount of income-tax chargeable u/s 45(4) is to

be reduced from the full value of consideration of the assets transferred by

the firm (specified entity). Relevant, provision is reproduced as under,

(iii) in case of value of any

money or capital asset received by a specified person from a specified entity

referred to in subsection (4) of section 45, the amount chargeable to income-tax as income of

such specified entity under that sub-section which is attributable to the

capital asset being transferred by the specified entity, calculated

in the prescribed manner:

4.12. The manner of determining amount

to be attributed to capital asset is prescribed by newly inserted rule no 8AB

and explained in the guideline issued by CBDT on 2nd July 2021 vide

circular no.14/2021. Said rule provides that,

a. Amount of tax shall be

attributable to the REMAINING CAPITAL ASSETS (sub rule 2 of rule

8AB)

b. Only if, such tax, on the

aggregate of the value of money and the FMV of capital asset exceeding capital

balance, RELATES to revaluation of any capital asset (sub rule 2

of rule 8AB)

c. If such excess DOES NOT

RELATES to revaluation of any capital asset then no attribution is to

be done (sub rule 3 of rule 8AB)

d. If such excess relates only to

the capital asset received by partner then no attribution to be done (sub rule

4 of rule 8AB)

e. Such tax SHALL RELATE

to revaluation of any capital asset or valuation of self-generated goodwill, if

revaluation is based on a valuation report obtained from a registered valuer as

defined in clause (g) of rule 11U (explanation no.1 in rule 8AB)

f. Amount of tax to be attributed

shall be determined in proportion: increase in or recognition of value of that

remaining asset to aggregate of increase in or recognition of value of all

assets because of revaluation or valuation (sub rule 2 of rule 8AB)

4.13. Accordingly, continuing with the

example discussed at para no. 4.8 above, let us determine the value of

attribution to be done as per section 48(iii):

a. Tax chargeable u/s 45(4) = Rs.20

(for both the assets as mentioned at paragraph 4.10.2 above)

b. Said tax of Rs.20 is to be

attributed proportionately to remaining capital assets G and H in the

proportion to their increase in the value due to revaluation. In the instant

example, both the assets G and H have increased by Rs.150 each from book value

of Rs.50 to revalued amount to Rs.200 each. Thus, the attribution of Rs.20 has

to be equal i.e. Rs.10 each amongst capital asset G and H.

c. Thus, whenever these two capital

assets i.e. G and H are transferred, Rs.10 would be reduced from the full value

of consideration. I.e. for example, Asset G is transferred in subsequent year

for full value of consideration of Rs.350 then from this full value of

consideration Rs. 80 (assumed to be indexed cost of acquisition) and Rs.10

[being attribution as per section. 48(iii)] would be reduced. Thus, net taxable

capital gains would be Rs.260/-.

d. Since, attribution is to be done

on remaining capital assets, if there are no other capital assets remaining with

the firm after distribution then there would not be any attribution.

5. Conclusion:

5.1. In case where new partner is

admitted, tax under section 9B and 45(4) would be determined only in case where

any of the partner receives any capital asset/ stock in trade/ Money. That is

to say, happening of reconstitution (including admission of new partner) just triggers

provisions of section 9B and 45(4) but, taxation will arise only when capital

asset/ stock in trade/money is received by the partner.

5.2. Further, provisions of section 45(4)

charges to tax the Profit or Gain arising to partner/s, who receives any

asset or money or both from the firm as a result of reconstitution of the firm,

but the burden to pay tax on such gain is shifted on the firm (being deemed

income). While, provisions of section 9B taxes the gains arising to the

firm whenever partners take away Capital Asset or Stock in Trade or

both as a result of reconstitution or dissolution of the firm.

6. Frequently Asked Question

6.1. If partner/s receive/s stock in trade, would it be taxed twice i.e. first as per section 9B and then under then head PGBP?

Ans. No, provisions of section 9B

routes the taxation to relevant heads of income. Thus, in case stock in trade

is received by partner, it would be taxed as income U/Sec.28 i.e. PGBP of the

Firm.

6.2. If the amount of tax u/s 45(4) is

attributed to capital assets being part of Block of asset then, whether said

amount of attribution be added to carrying amount of WDV of the ‘block of

asset’?

Ans. It appears the answer is ‘No’,

since provisions of section 43(6) related with WDV and Actual cost have not

undergone any change as of date. Thus, WDV won’t be adjusted by the value of

attribution and accordingly depreciation would not be computed on the same.

6.3. Whether admission of minor to partner

would have any separate implication?

Ans. Mere admission of new partner

does not have any implication unless any capital asset/ stock in trade/ money

is received by any partner in connection with such reconstitution. If, any

partner receives any capital asset/money/ stock in trade then, taxation would

be done according to the new scheme explained above.

6.4. Whether benefit of section 54EC

would be available to the firm?

Ans. Since provision of section 9B

states that the chargeability of tax on capital assets is under the head ‘Capital

Gains’, the benefit of said provision would be available to the firm.

6.5. In case new partner pays consideration

while joining the firm to the existing partners sans ‘Firm’ (i.e. outside the

books of accounts) and reconstitution takes place then whether the provisions

of section 9B and 45(4) are applicable?

Ans. It appears

the answer is ‘No’.

Provisions of section 9B and 45(4) are invoked only when any capital asset,

stock in trade or money is transferred by the firm

6.6. In case of transfer of capital

asset, whether benefit of indexation is available for determining gains u/

45(4) or section 9(B) or both?

Ans. Provisions of section 9B charges

tax on the gains arising due to transfer of capital asset while the taxability is to be determined as

per the provisions of head ‘Capital Gain’. Thus, for determining capital gains provisions

of section 48 have to be applied. While, provisions of section 45(4) taxes the

gains arising to the partner/s and not the transfer of asset, thus benefit of

indexation may not be allowed while determining gains u/s 45(4).

6.7. Whether benefit of newly inserted clause (iii) u/s 48 is available to capital assets transferred at time of reconstitution/ dissolution or other remaining capital assets?

Ans. According to the newly inserted

rule 8AB and the guideline issued u/s 9B on 02nd July 2021 (14/2021)

the attribution of taxes paid u/s 45(4) is to be done on REMAINING CAPITAL ASSETS

i.e. Capital assets remaining after transfer of capital assets in connection

with reconstitution.

Thanks and Regards,

Bhuvanesh V Kankani

B Com, CA, LLB

+91 9421847944

Disclaimer: This Article/ Write-up is entirely the personal opinion of the Author and should not be regarded or relied upon as legal advice by the Author. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although the Author has endeavored to provide correct information but the chances of error cannot be ruled out. Also, it be noted that above article/writeup is written considering the prevailing provisions of law, in case the the provisions change the Author is not bound to update the above article/writeup. No one should act on this information without appropriate professional advice. Author wont be held liable for any loss or delay.

It’s great to come across a blog every once in a while that isn’t the same out of date rehashed material. Fantastic read.Best Tax Services service provider.

ReplyDelete